The exponential growth of electric vehicles (EV) means that ICE (internal combustion engine) sales and gasoline demand have already peaked and will be in freefall by 2030. So the end of the ICE age has begun, putting at risk half of global oil demand. This is the subject of RMI’s latest report: X-change: Cars.

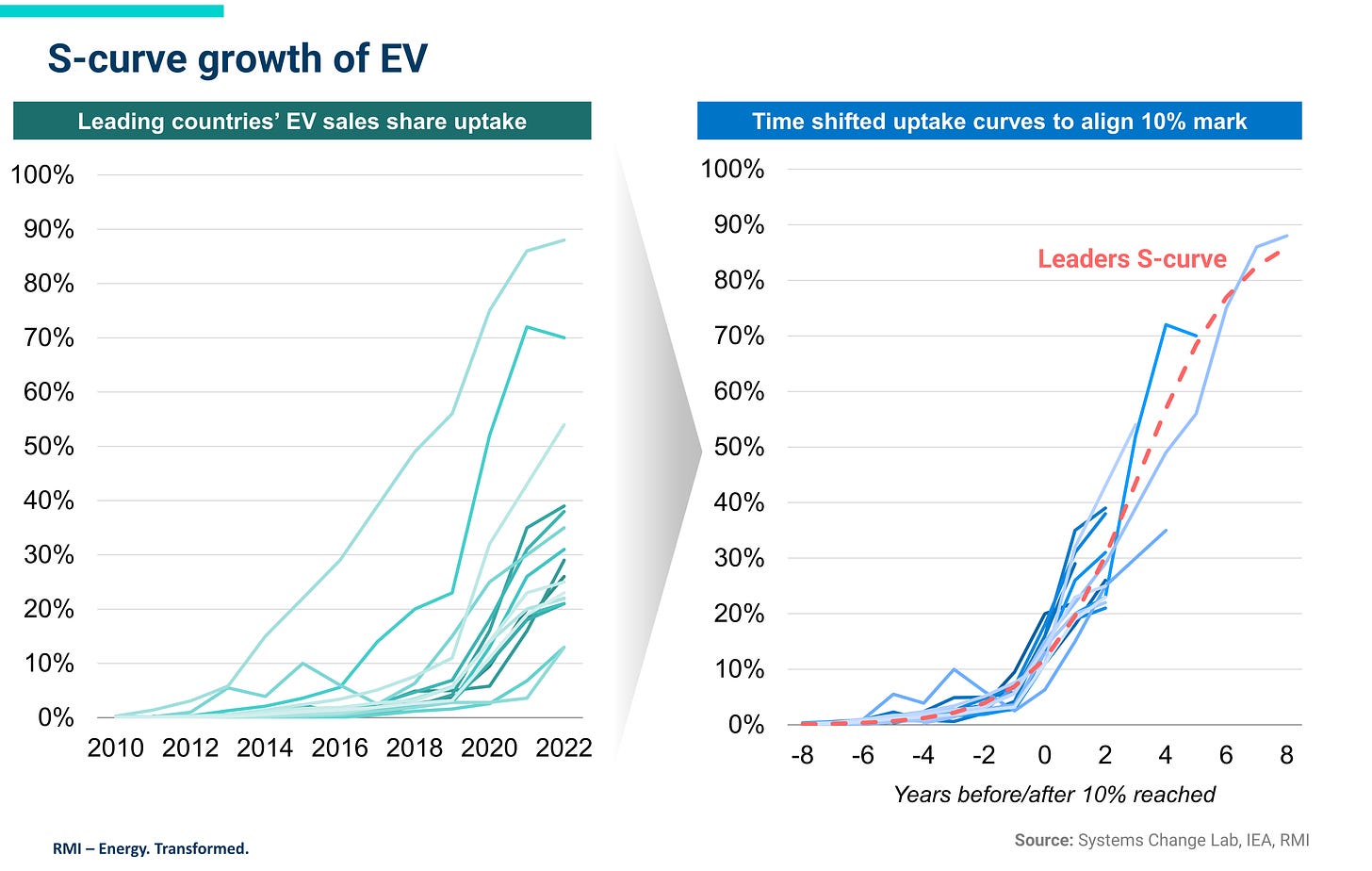

1. EV sales are growing exponentially up S-curves

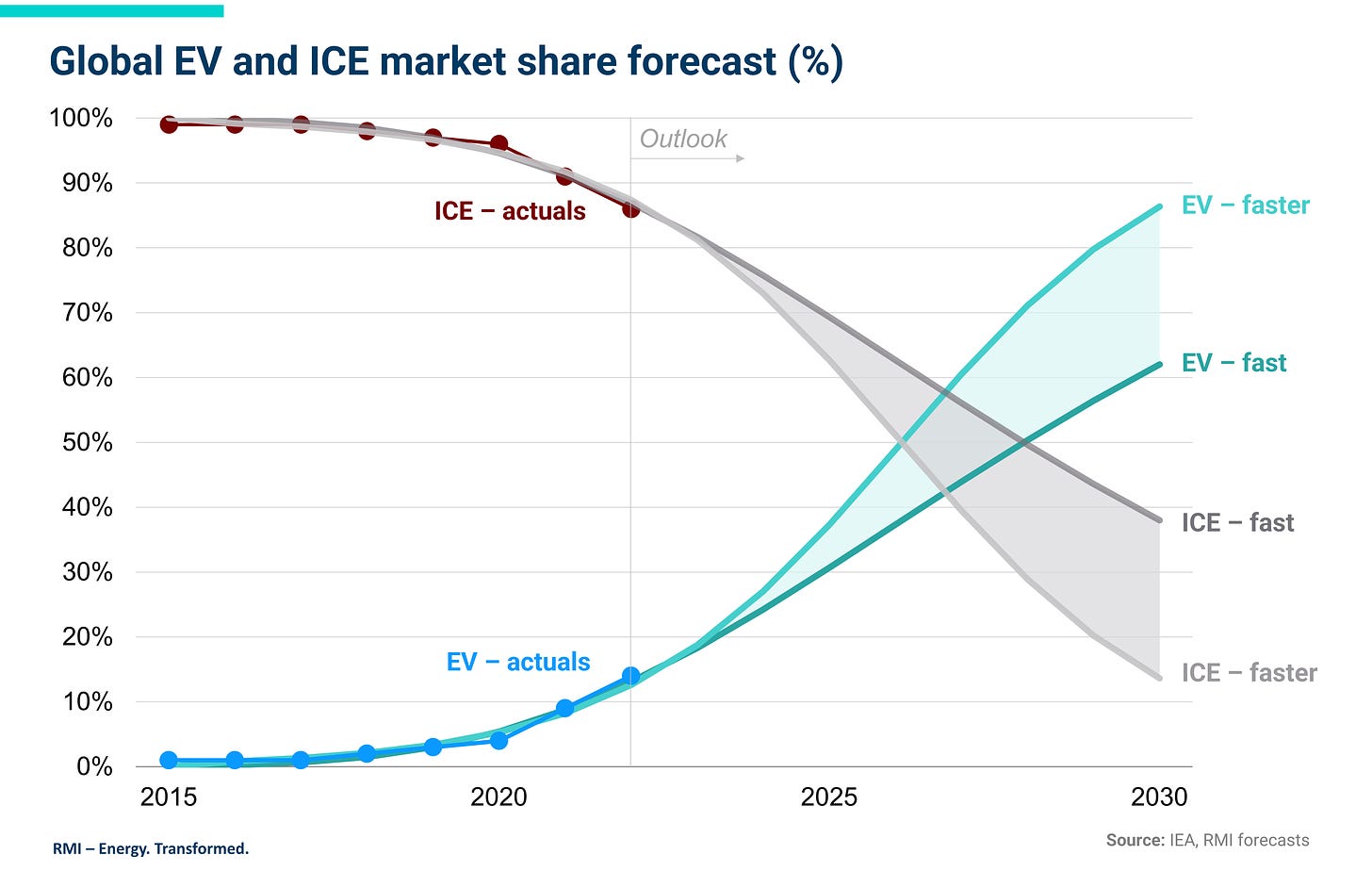

EV sales growth is on an S-curve, and one country after another is taking a similar path. In broad terms it is taking about six years for countries to go from 1% to 10% market share and then another six years or so for leading countries to get to 80%. Nearly one in five global car sales in 2023 will be an EV.

Exponential is the new normal

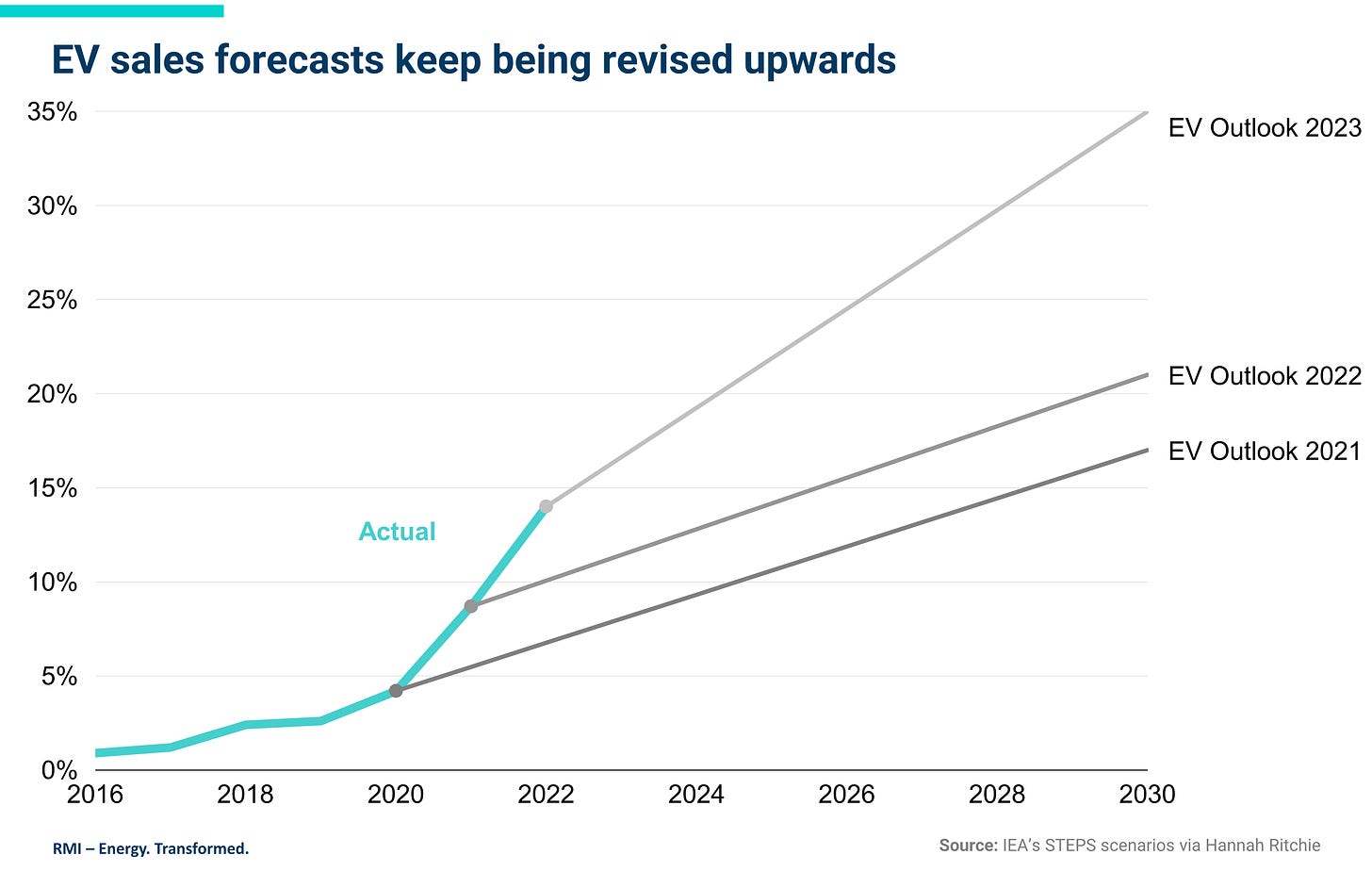

2. Forecasters have underestimated the speed of EV growth

Each year forecasters revise their EV market share projections upwards, as battery prices fall on learning curves, consumer preferences shift to EV, and leading countries figure out how to upgrade grids and deploy charging infrastructure. Consensus is currently clustered around an EV market share of 40% in 2030, but that would require growth to slow down dramatically. Such a slowdown is of course possible, but that is a contrarian position not a default one.

Linear thinking is the new contrarian position

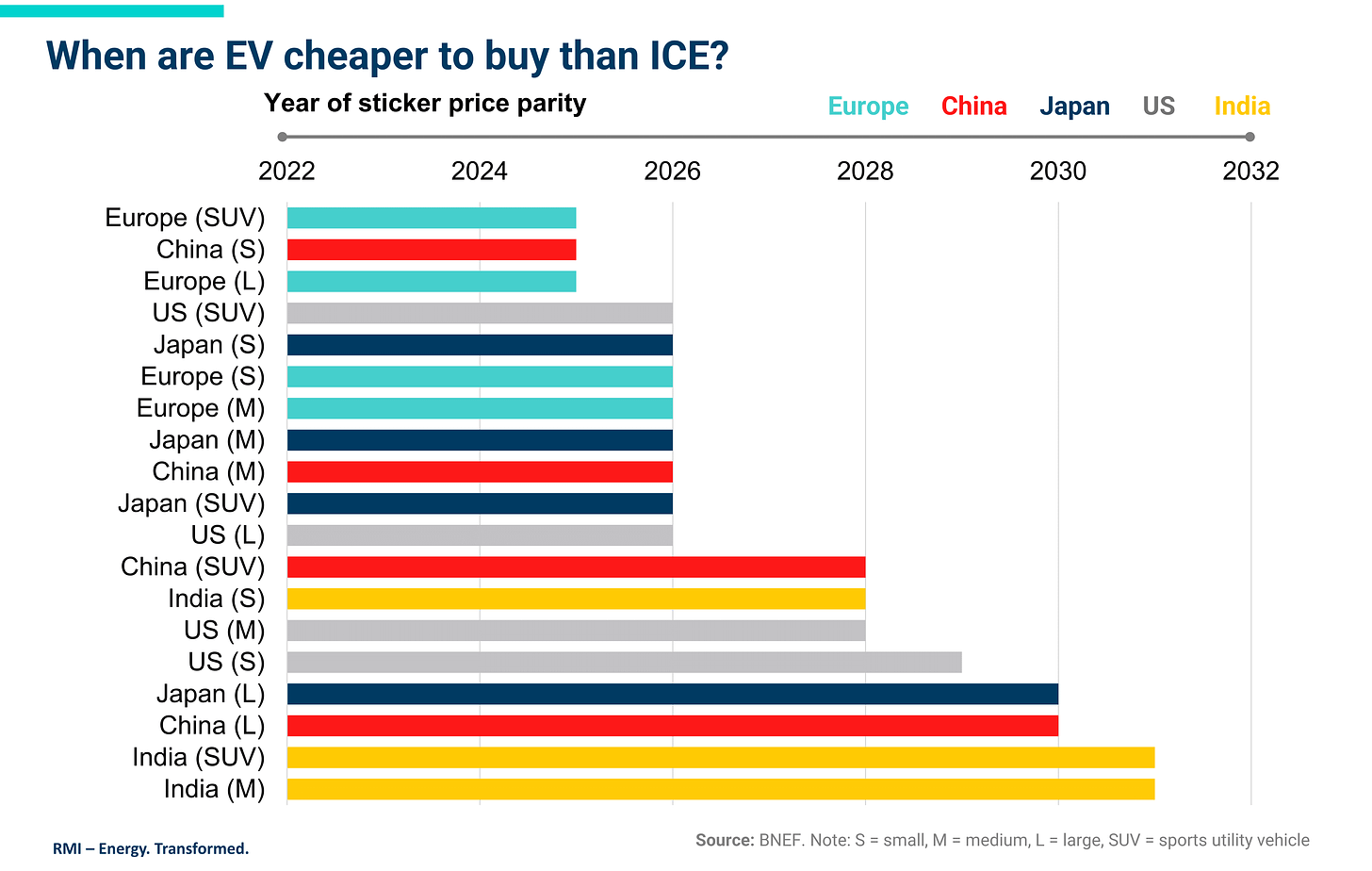

3. The drivers of change are getting stronger

The main driver of change has been policy but now it is being joined by economics and the race for technology leadership. Continuity on learning curves implies battery prices will halve by 2030, enabling every major country and vehicle type to enjoy sticker price parity. Meanwhile, Chinese leadership has sparked a race to the top to dominate the EV technologies of the future.

From policy push to economic pull

4. Exponential growth will continue

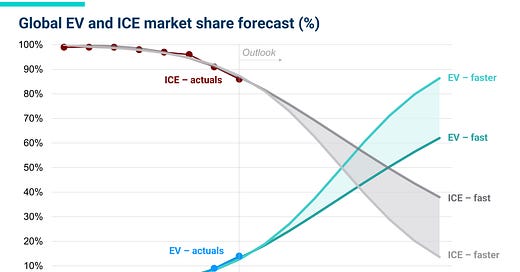

Our S-curve modelling, based on the EV growth so far and the lessons of other technology shifts, suggests EV sales will grow at least four-fold by 2030, and make up between 62% and 86% of global car sales in 2030. EV sales could overtake ICE sales as early as 2026.

The future lies between fast and faster change

5. The growth of EV pushes the ICE fleet and oil demand for cars into terminal decline

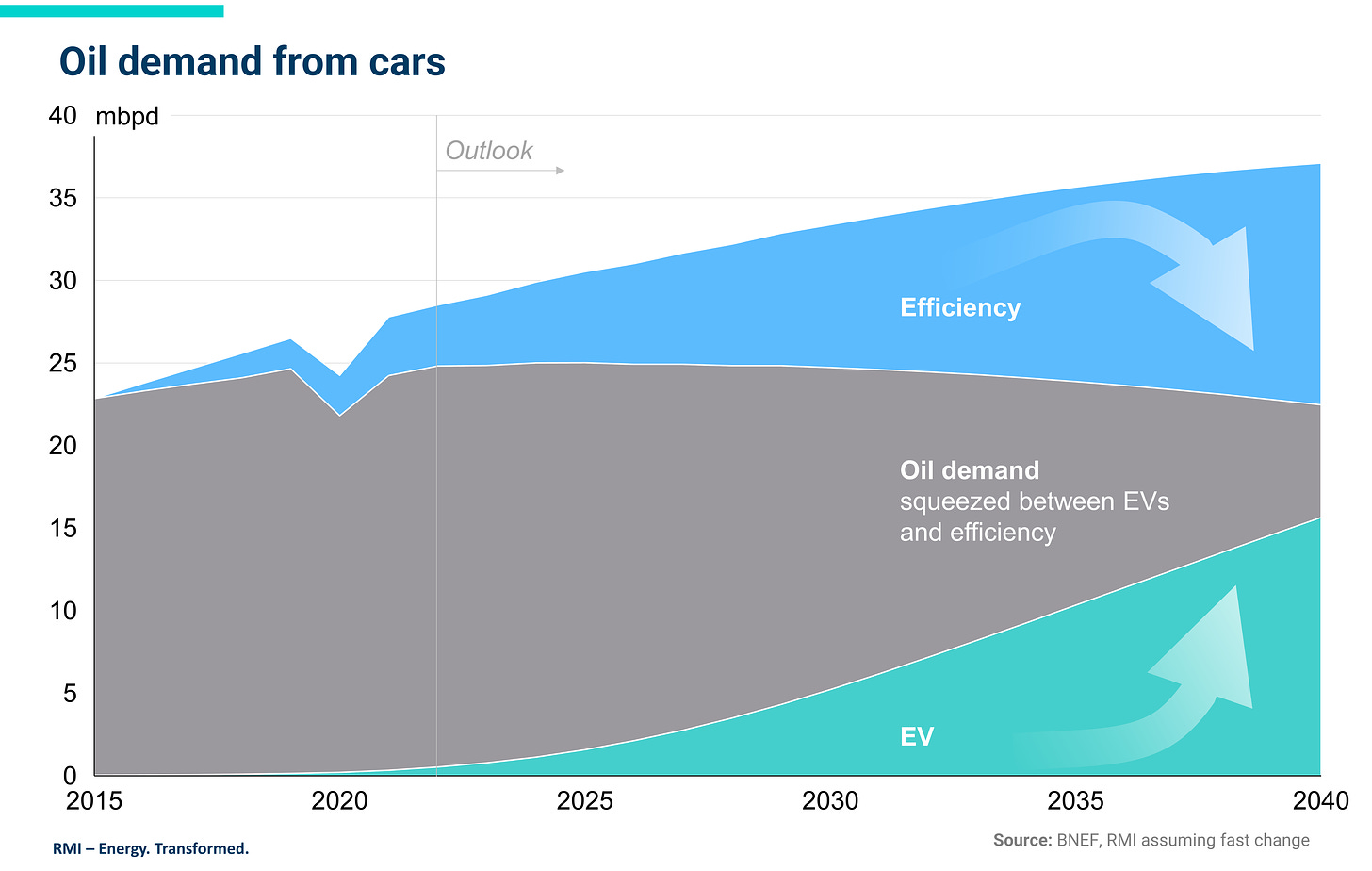

The growth of EV up S-curves means that ICE sales peaked in 2017, gasoline demand peaked in 2019, and the ICE fleet will peak in the middle of the decade. Oil demand for cars will then be squeezed between continued efficiency gains and the rise of EV. Once EV make up the vast majority of car sales, the world is around 15 years away from a quarter of oil demand falling to zero. And where cars lead, so a similar path is taken by 2-wheelers in the Global South and trucks in developed markets, meaning that half of global oil demand from the road sector will soon be at risk.

Squeezed between efficiency and EV

The end of the ICE age is here, but we cannot rest on our laurels; challenges are many and we need to keep solving them. For motivations as diverse as costs, peace, air pollution and climate, it is essential to make this fast transition faster.

Spectacular news!